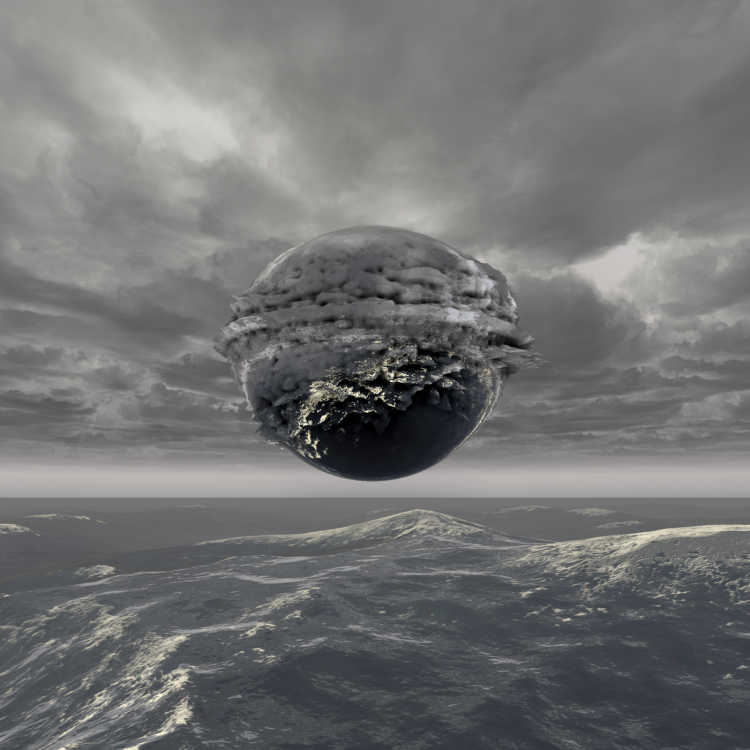

Francesca Fini, Old Money Venus (Virtual Venus #5), 2021, Courtesy of the artist

NFT 101: A Primer for Creators, Merchants and Collectors

NFTs - short for ‘Non-Fungible Tokens’ are unique cryptographic tokens stored on blockchains. They can represent anything, from domain names to memes, game characters and virtual accessories.

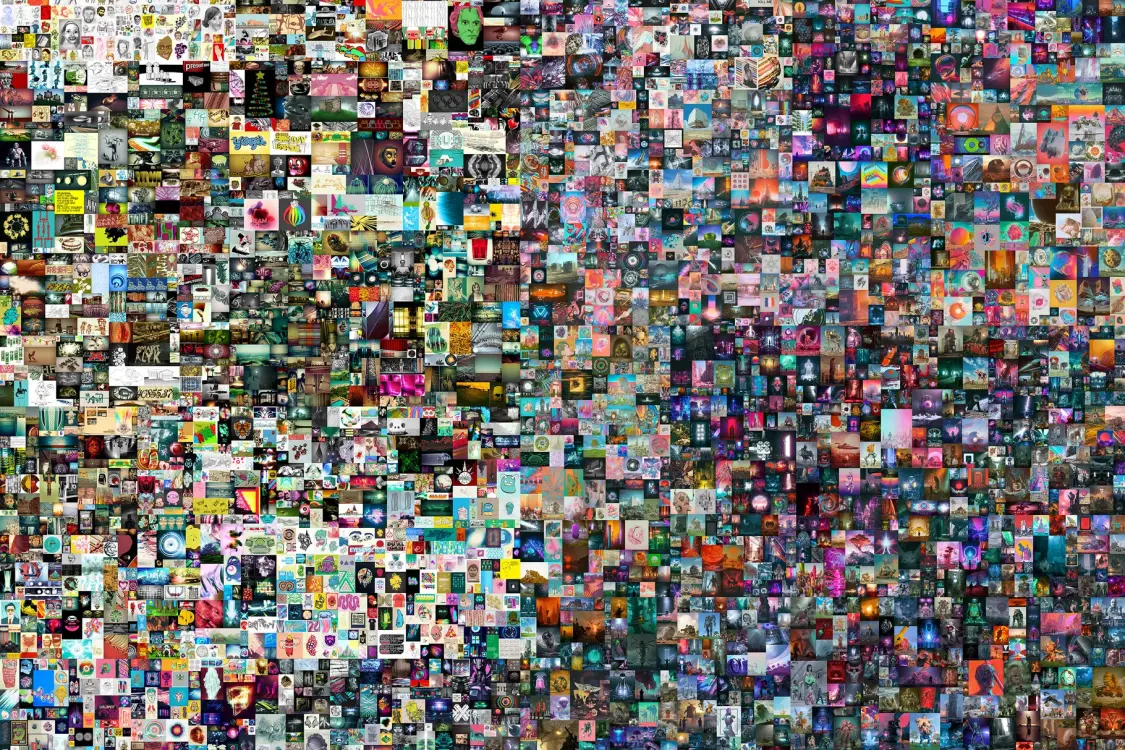

In 2021, NFTs officially entered our cultural lexicon, perhaps unsurprising given that the market reached $2.5 billion in sales in the first quarter of the year. Back in March, Mike Winkelmann, aka Beeple, sold his digital artwork ‘Everydays: the First 5000 Days’ for $69 million at a Christie’s auction. Not only was this one of the most expensive works to ever be sold, but it also marked one of the first times a major auction house sold a native digital work as an NFT and accepted cryptocurrency (in this case Ethereum) in place of fiat, or mainstream currency. So what are NFTs, how do they have value, and what’s all the hype about, exactly?

The basics

What are NFTs?

NFTs, short for ‘Non-Fungible Tokens’, are unique cryptographic tokens stored on blockchains. They can represent anything, from domain names to memes, game characters and virtual accessories. Within the art world they are most widely associated with digital artworks and collectibles.

Fungible means two things are interchangeable, for example, a one-dollar bill can be easily exchanged for another one-dollar bill. For something to be ‘non-fungible’ it can’t be exchanged with something else. A Leonardo da Vinci painting is not the same as a Leonardo da Vinci poster. Each NFT represents a single non-fungible thing and its uniqueness is publicly verifiable on the blockchain.

How do NFTs work & how does this fit into blockchain?

Blockchain is the technology underlying NFTs. Blockchain is a shared, open, immutable and distributed database made up of a list of records, or blocks. Each block consists of a cryptographic hash - a string of characters representing a set of data - of itself and the previous block, therefore linking the data together in chronological order. You can’t change or alter any content without it being obvious to anyone who checks the cryptographic hash, meaning that the data cannot be maliciously changed.

How NFTs work

Many NFTs are represented by a set of rules on the Ethereum blockchain called the ERC-721 token standard. The ERC-721 standard is able to represent unique digital files by capturing additional metadata relating to a file. With digital artworks, for example, this could include details relating to the artwork, the creator and its owners.

It’s worth noting here that while most NFT activity takes place on the Ethereum blockchain, a number of other blockchains and contracts also support NFTs, such as Bitcoin Cash, Flow, NEO, Wax, Tron and Tezos.

Where do smart contracts come in?

Smart contracts are computer programs that are permanently built into blockchains to facilitate the automatic execution of contractual agreements between parties. Smart contracts can also be embedded in NFTs to facilitate the sale and transfer of digital artworks and collectibles, without the need to rely on trusted third parties.

Understanding public and private keys

To execute transactions on the blockchain, users are required to have a public and a private key. These are used for signing messages on the blockchain and enhancing security and identification.

A private key consists of a randomly generated sequence of values known only by its owner and can be used to generate digital signatures (analogous to paper-signatures but with added security). Only the owner of the private key can generate these signatures, but anyone can verify them by using the public key. This ensures that you can verify the identity of who made a transaction on the blockchain.

How do NFTs have value?

As NFTs cannot be replicated, they create verifiable digital scarcity. NFTs can ascribe, document, and track distinctive attributions of digital assets such as ownership and ownership history. This permits them to be bought, sold and exchanged through marketplaces that recognize that deed of ownership, such as crypto-gaming, crypto-collectables and digital art.

What does it mean to ‘mint’ an NFT?

To ‘mint’ an NFT is to register it on the blockchain and to ascribe ownership of that file to a specific user’s wallet. In most cases, once the NFT has been registered and its metadata is frozen, the NFT is tamper-proof and cannot be changed or altered in any way. The cost of minting varies across platforms, however creators usually have to pay a ‘gas fee’ that covers the computational power required to process transactions on the blockchain.

Where are NFTs stored?

NFTs are usually stored on the blockchain they were initially minted on. Blockchains are not necessarily interoperable with each other. An NFT minted on one blockchain cannot be transferred to another.

The artwork file and metadata are not usually stored on the blockchain. While this is possible, it’s prohibitively expensive, and so information about the artwork is stored on-chain and this points to the file's address. This can typically be accessed through an off-chain storage site such as the InterPlanetary File System (IPFS); a distributed server used for storing and sharing data. Although the data isn’t stored on chain, by storing a cryptographic hash on-chain, you can ensure that the off-chain file is valid.

Where to Buy, Sell & Share NFTs

A myriad of NFT marketplaces facilitate the sale of digital artworks: SuperRare, Opensea, Rarible and Makersplace, to name a few. Other platforms provide more specialized markets in digitally scarce collectible goods, including Bored Ape Yacht Club, a platform where users can trade Bored Ape avatars; NBA Top Shot, where fans can buy and sell editioned versions of video highlights of NBA players; and Hashmasks, a platform for unique digital portraits that can be named by their owners.

Several blockchain projects aim to converge physical, augmented and virtual reality in a shared online space known collectively as ‘the metaverse’. One example is Decentraland, a 3D, virtual reality platform where users can interact with other ‘players’ through online virtual avatars and buy and sell virtual lands and estates. The platform also hosts a variety of digital NFT exhibitions and other types of virtual events.

What are the benefits of NFTs? Digital scarcity & proof of ownership

By providing proof of ownership and verifiable uniqueness to digital assets, NFTs have created new markets, allowing more creators, and crucially digital artists, to support themselves through their creative practice. The ability to now own something that exists in a natively digital form has opened up new ways of valuing creative works outside the parameters of the traditional art market, placing more power into the hands of everyday creators.

Price Transparency

Due to the public nature of blockchain, transactions for a creative work can be viewed and validated by anyone, at any point in time, whilst still protecting the privacy of artists and collectors. The improved traceability and transparency across transactions is leading to a more open creative market for everyone.

Resale royalties

One of the main advantages of NFTs is the ability to issue royalty payments to creators at the point of secondary sale. Royalties are issued using smart contracts. In theory, because smart contracts are self-enforcing - they are automatically enacted if certain pre-programmed parameters are met - there is no need to rely upon trusted third parties to fulfil certain conditions.

The promise here is that, providing that the artwork or collectible continues to circulate on the secondary market, these royalties are automatically issued in perpetuity to the original wallet that the NFT was first minted with. Despite this, royalties aren’t necessarily universally honored.

Are there any pitfalls?

Cross-market interoperability

There are issues with NFT royalties that need to be ironed out, especially cross-market interoperability. Each marketplace has their own approach to artist royalties and operates differently, meaning that royalties often only work on the platform through which the NFT was originally minted and offered for sale. This lack of standardization across NFT marketplaces means that the automatic enforcement of artist royalties may not always come to fruition.

It’s worth mentioning here that the ERC-2981 standard has since emerged as a way to enable royalty payments regardless of the marketplace it was sold or resold on. Despite this, if the marketplaces choose not to implement this royalty payment standard on their platforms then the market will lack an agreed standard that will benefit the entire ecosystem.

Fraud and hacking

In addition to the aforementioned issues with resale royalties, crypto-counterfeiting and hacker schemes are becoming more sophisticated and elaborate. In April 2021, Beeple’s wallet was hijacked. NFT artworks were stolen by a hacker operating under the pseudonym ‘Monsieur Personne’; a technique otherwise known as ‘sleepminting’. On August 24, a Banksy impersonator scammed a collector for $330k.

Although NFTs provide a transactional record of who has minted and owned the work, many NFT marketplaces don’t make it a requirement for artists to verify their identity at the point of minting. Scams highlight vital questions surrounding the difference between creative and transactional authenticity as well as the continued importance of proving the legitimacy of artworks even in the digital realm.

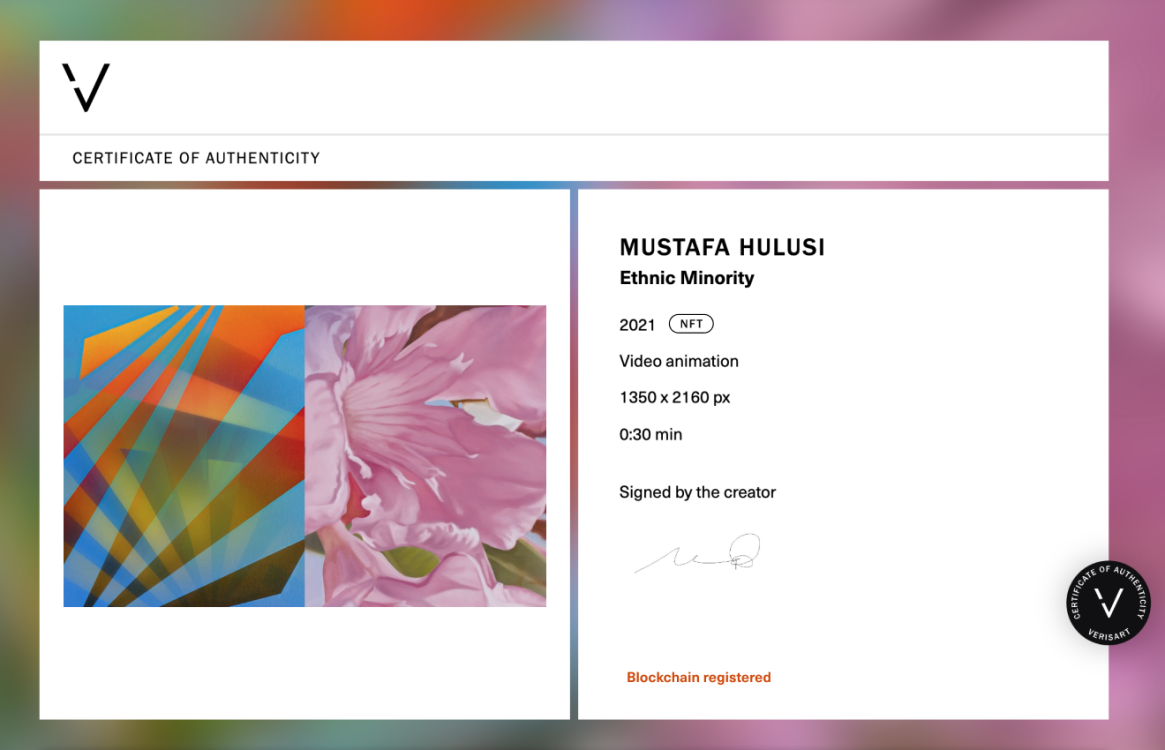

At Verisart, we always verify the identities of artists creating Certificates of Authenticity and verify that users have linked their Verisart account to the wallet that owns the NFT, providing a clear link between creator and creation that is vital to building trust within the NFT market.

We are an international team of art and technology professionals challenging the status quo of the art and collectibles market. Head over to our main page to find out more about creating free museum-quality Certificates of Authenticity with Verisart, securely registered and recorded on the blockchain.

References:

Cryptopedia (2021). CryptoKitties: A Pioneer in Ethereum Gaming and NFTs. Cryptopedia.

Opensea (2021). What is Freezing Metadata? Open Sea Help Centre.